Only for GDS by GDS - India Post

Tuesday, 28 August 2018

Monday, 27 August 2018

India Post Payment Bank ( IPPB ) : Technology Revolution for Rural India & Social Reform for their existence of Government of India & Bonded labour system for Gramin Dak Sevaks

India Post Payment Bank ( IPPB ) : Technology Revolution for Rural India & Social Reform for their existence of Government of India & Bonded labour system for Gramin Dak Sevaks.

Minutes of the IPPB meeting with staff representatives held on 29.06.2016,

As per minutes of the meeting with staff representatives held on 29.06.2016, staff representatives raised the issues regarding role of GDS staff & working hours and it was agreed by the officers of IPPB , that these issues particularly removal of cap on working hours are beyond the purview of the meeting and are being duly examined separately by the concerned authorities.

The minutes are as follows

In Nov’2017 DoP asked comments & views from all Federations and Unions on IPPB. On 23.11.2017 FNPO wrote a letter to Secretary on the role of GDS exclusively in IPPB.

If GDS is a part of IPPB for improvement in rural areas , then the work pressure and working hours will be more than 5 hours.

If this situation arises , removal of Rule 3A(i) of GDS Conduct & Engagement Rules,2011 in respect of GDS can be made possible or not ?

Letter as follows

On 7.3.2018 one workshop was conducted by DoP with the representatives of service unions on sensitization of IPPB.

FNPO is welcoming the IPPB proposal with a condition for not privatising /corporatizing DoP in future. And it is the responsibility of DOP for any financial loss cause of IPPB. We also demand for immediate remedy of staff shortage in all cadre.

Regarding GDS FNPO is totally opposing incentive system proposal in IPPB and demanded for the work should be taken into account for calculation of GDS work load and cap on working hours should be removed.

According to GDS pay report every BO is having 886 live accounts and many of the BPMs are working for more than 10 hours.

AP circle RTI information and relevant evidences also submitted. IPPB is going to tie up with 11 ministries from which 52 welfare services are distributed to public.

After inauguration of IPPB each and every GDS irrespective of the cadre has to work for more than 10 hours. In view of these FNPO demanded for removal of CAP on working hours i.e; 5 hours( Rule 3 A(i) ).

In the above said workshop all Federations & Unions refused incentive to GDS staff and raise their voice towards removal of Rule 3A(i) of GDS Conduct& Engagement Rules,2011 and a memorandum submitted to Secretary , Posts.

Memorandum as follows

Indefinite Hunger Fast by NUGDS President ,CHQ from 12.03.2018 to 14.03.2018 at Visakhapatnam, Andhra Pradesh Circle demanding

1. The earlier nomenclature of GDS (Conduct &Service) Rules ,1964 may be restored to enable the GDS to enjoy civil servant status. Accordingly the present GDS rules may be modified.

2. The existing Rule 3A (1) may be modified to enable the Sevaks to get pay and allowances as per work load following the law laid down by the Supreme Court i.e. Equal pay for equal work.

3. To implement the recommendations of GDS Committee report.

But till date DoP has not turned up with any positive reply to the above said letters and memorandums but simply announced a incentive structure to GDS for IPPB work.

The factor of Rs.1,000 /Rs.2,000 incentive per month will not compensate for the work being done above the regular duties of GDS working hours.

So, all Federations and Unions should take a remarkable step for removing the cap i.e 5 hours on working hours of GDS by abolished the GDS Conduct&Engagement Rules,2011 and restoration of ED (Conduct & Service ) Rules,1964 which are statuatory, legal and constitutionally valid.

CH.Laxmi Narayana.

Thursday, 23 August 2018

Wednesday, 22 August 2018

Payment of TRCA to outsiders working in the leave vacancies of GDS [Union Request dated 08/08/2018]

Payment of TRCA to outsiders working in the leave vacancies of GDS - AP Circle National Union of GDS

PM Modi to launch India Post Payments Bank on September 1

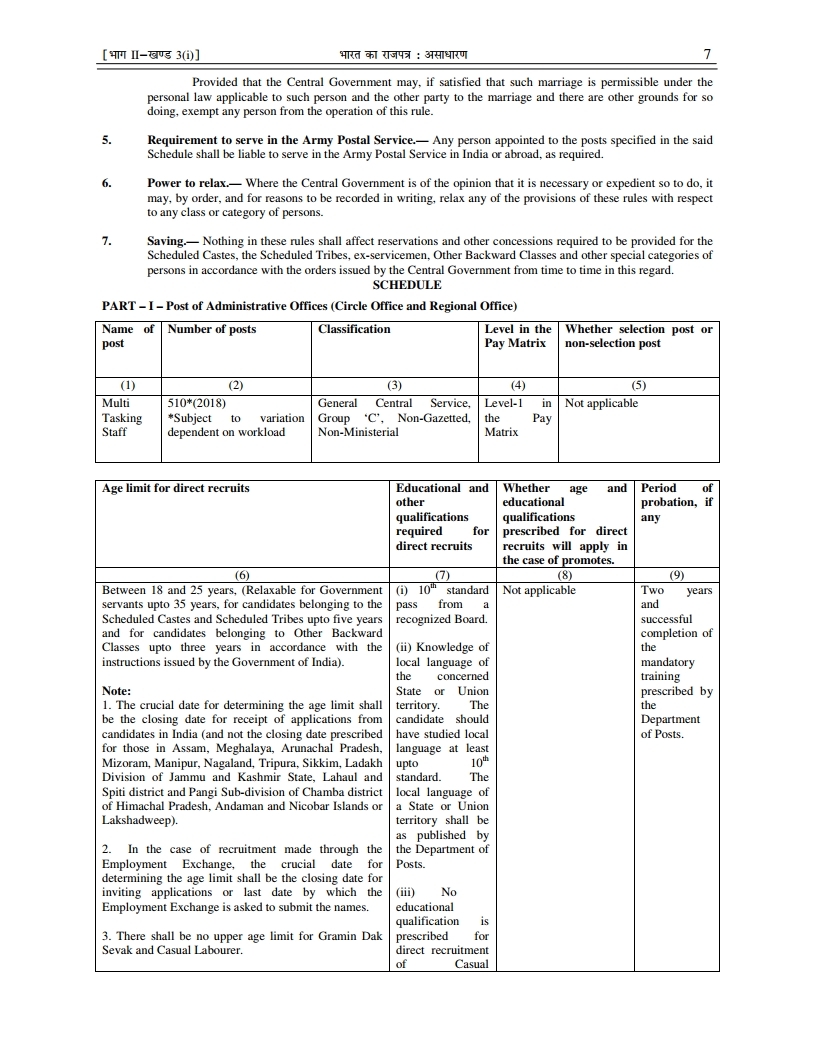

Prime Minister Narendra Modi on September 1 will launch long-awaited India Post Payments Bank (IPPB) that will have at least one branch in every district and focus on financial services in rural areas, a senior official said.

Prime Minister Narendra Modi was to launch IPPB on August 21. IPPB will leverage reach of 1.55 lakh post office branches to provide banking and financial service to people in rural areas. (PTI)

Prime Minister Narendra Modi on September 1 will launch long-awaited India Post Payments Bank (IPPB) that will have at least one branch in every district and focus on financial services in rural areas, a senior official said. “The launch of India Post Payments Bank has been rescheduled for September 1. The Prime Minister will launch,” a senior government official told PTI. The launch of India Post Payments Bank (IPPB) was recently rescheduled in the wake of seven-day national mourning declared after the demise of former Prime Minister Atal Bihari Vajpayee.

Prime Minister Narendra Modi was to launch IPPB on August 21. IPPB will leverage reach of 1.55 lakh post office branches to provide banking and financial service to people in rural areas. “Government is trying to link all the 1.55 lakh post office branches with IPPB services by the end of this year,” the official said. This will create the country’s largest banking network with direct presence at village level.

IPPB CEO Suresh Sethi had earlier said that IPPB will go live with 650 branches in addition to 3,250 access points co-located at post offices and around 11,000 postmen both in rural and urban areas will provide doorstep banking services. IPPB has permission to link around 17-crore postal savings bank (PSB) accounts with its account.

With IPPB in place, people in rural area will be able to avail digital banking and financial services, including money transfer, to any bank account either with help of mobile app or by visiting a post office. IPPB was the third entity to receive payments bank permit after Airtel and Paytm.

Payments banks can accept deposits of up to Rs 1 lakh per account from individuals and small businesses. The postal payment bank has permit to carry RTGS, NEFT, IMPS transaction that will enable IPPB customers to transfer and receive money from any bank account. With the third party tie-ups, account holders in IPPB will be able to avail financial services as in case of a regular banking customer. The payment bank will be used by government to distribute NREGA wages, subsidies, pension etc.

The IPPB app which is expected to be launched on same day will enable customers to pay for services of around 100 firms including phone recharges and bill, electricity bill, DTH service, college fees etc that are present on Bharat Bill payments system of National Payments Corporation of India.

Source : FE

Tuesday, 21 August 2018

Monday, 20 August 2018

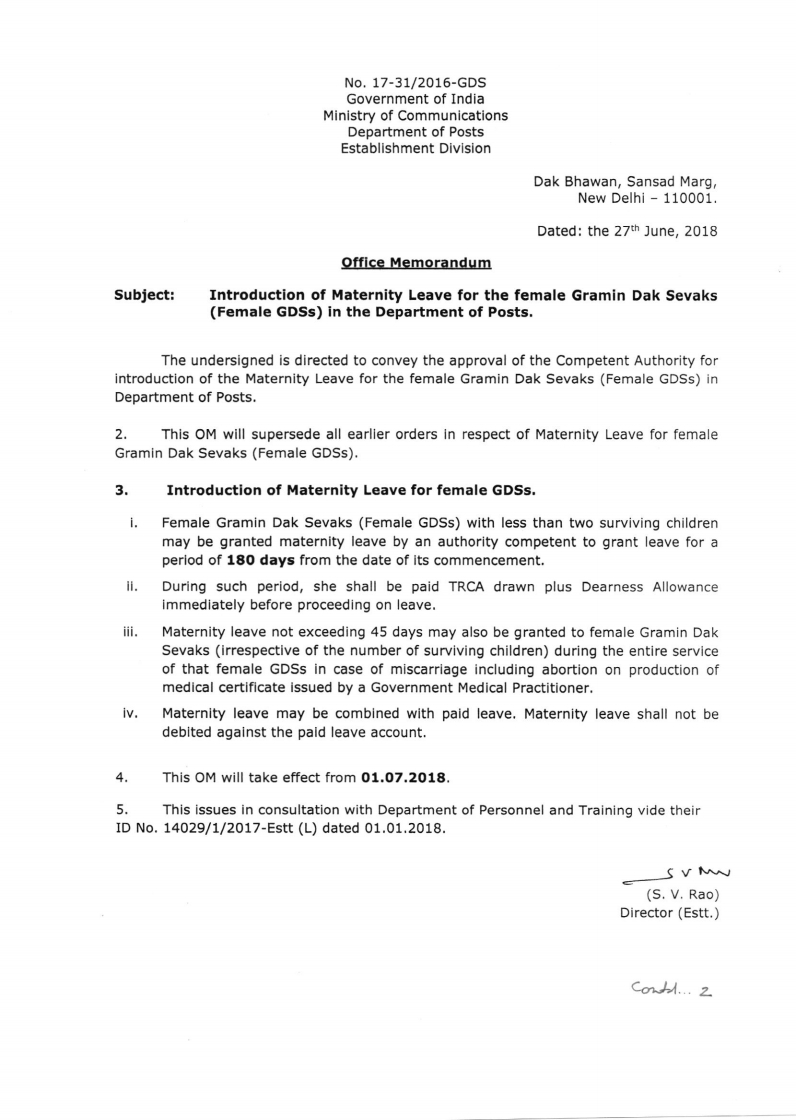

Introduction of Maternity Leave for the female Gramin Dak Sevaks (Female GDSs) in the Department of Posts

Introduction of Maternity Leave for the female Gramin Dak Sevaks (Female GDSs) in the Department of Posts

No.17-31/2016-GDS dated 27th June 2018

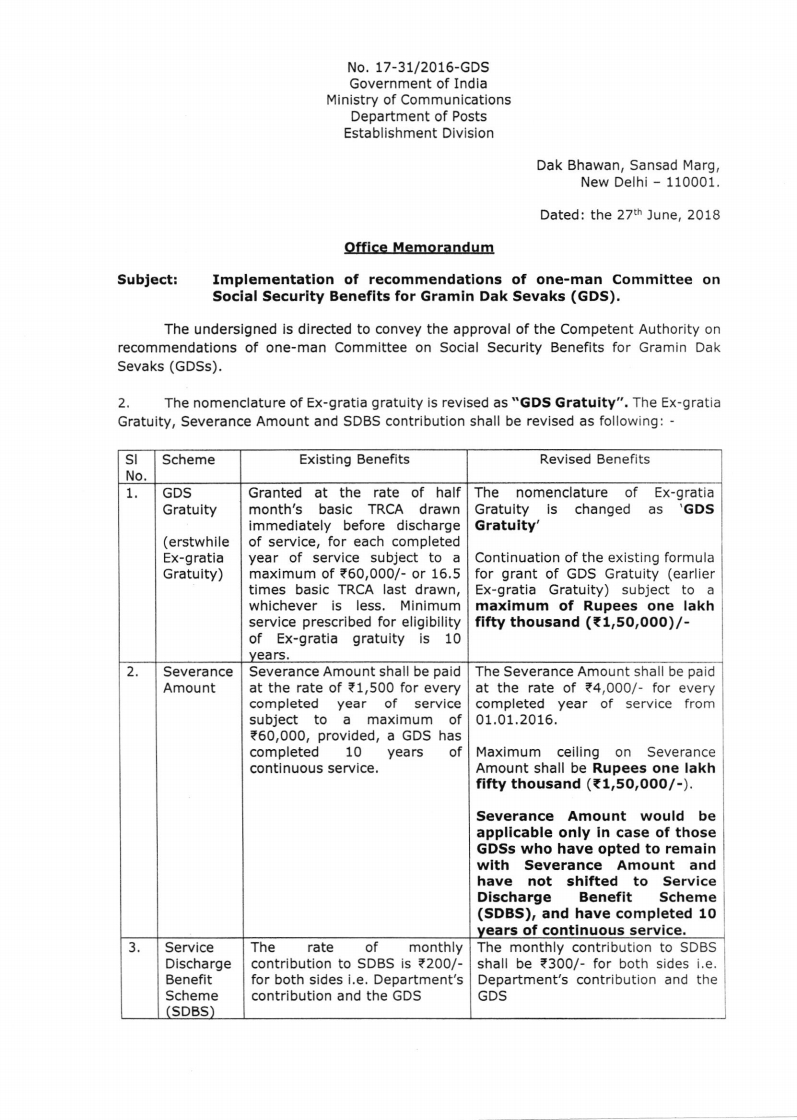

Implementation of recommendations of one-man committee on Social Security Benefits for Gramin Dak Sevaks (GDS)

Implementation of recommendations of one-man committee on Social Security Benefits for Gramin Dak Sevaks (GDS)

No.17-31/2016-GDS dated 27/06/2018

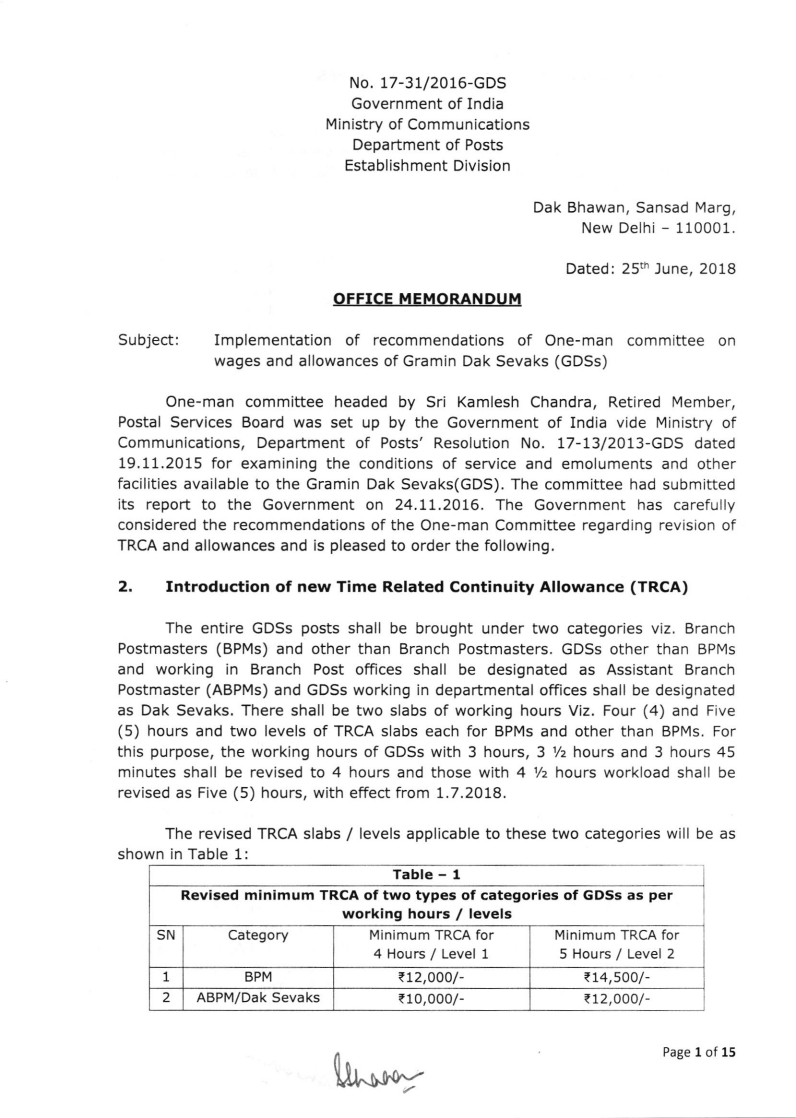

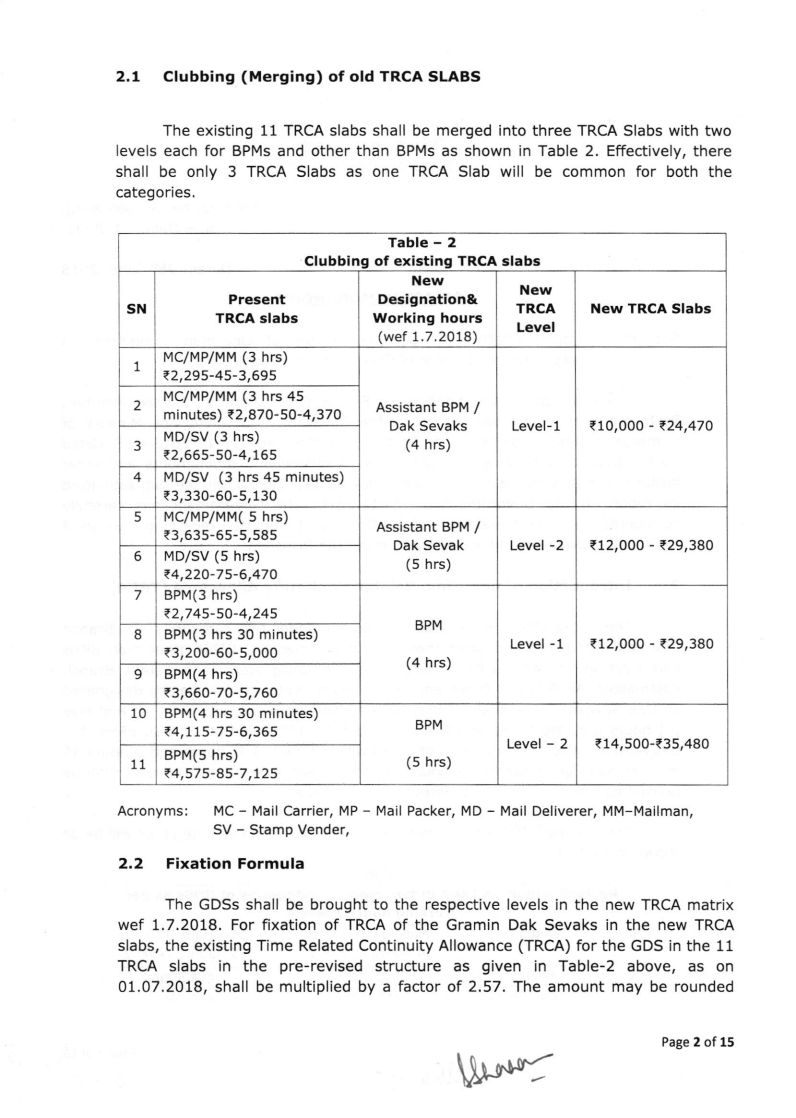

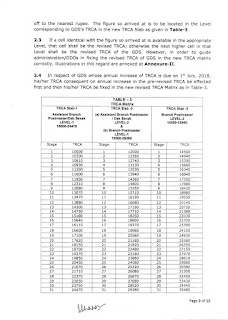

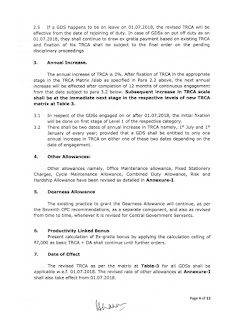

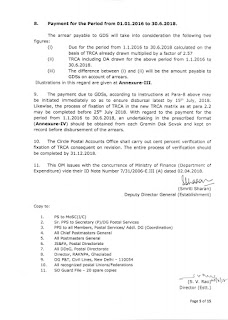

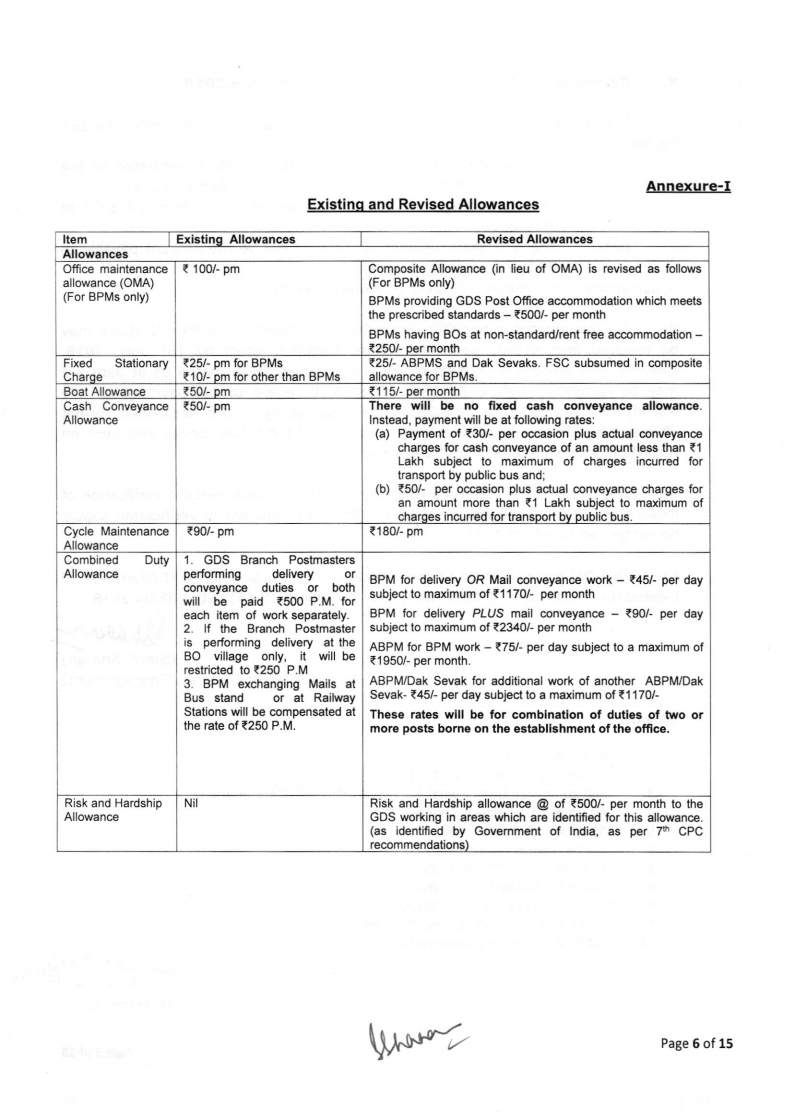

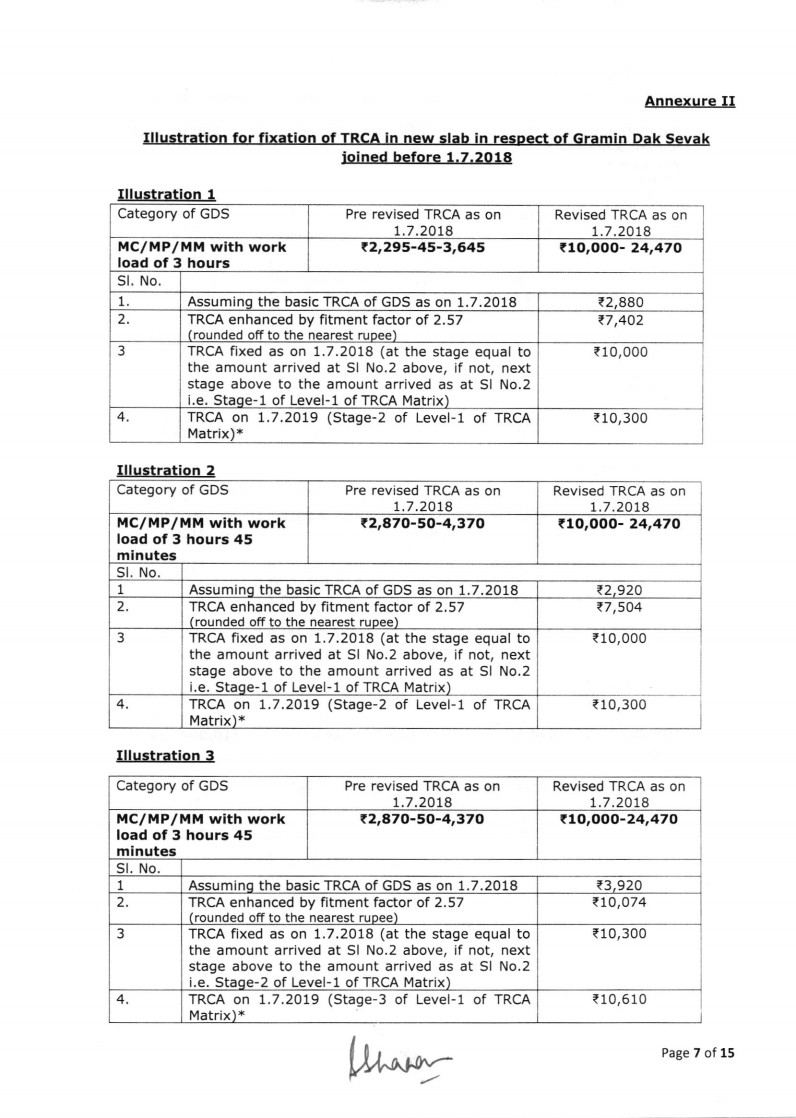

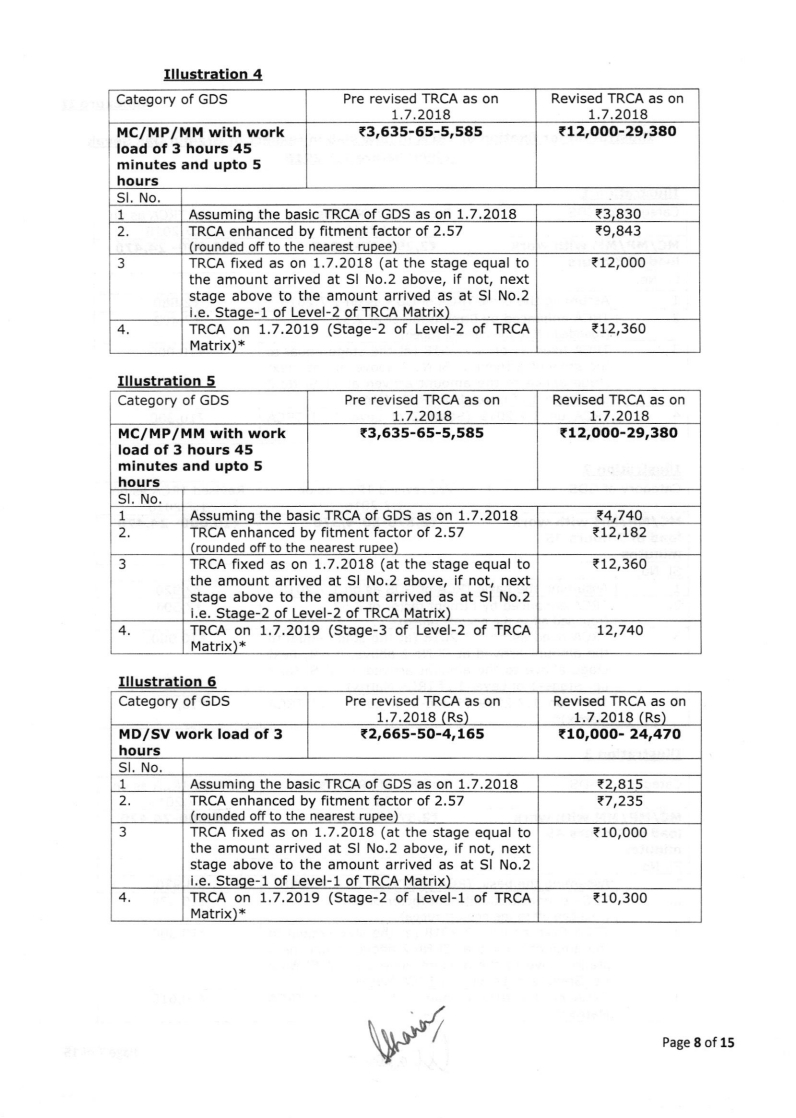

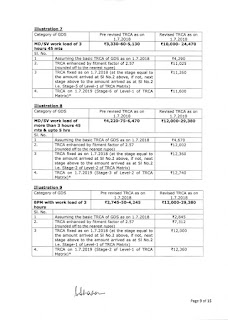

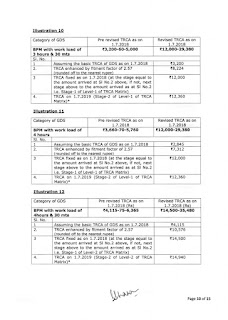

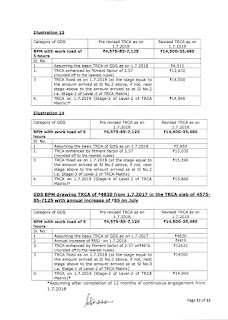

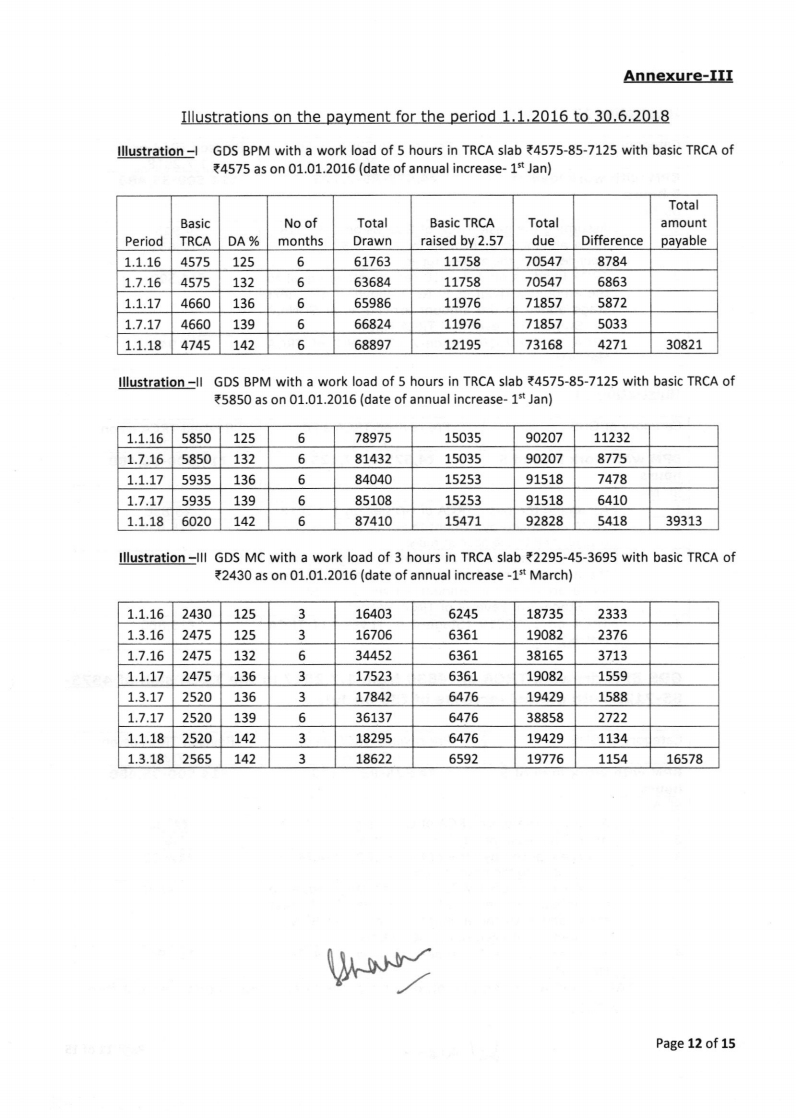

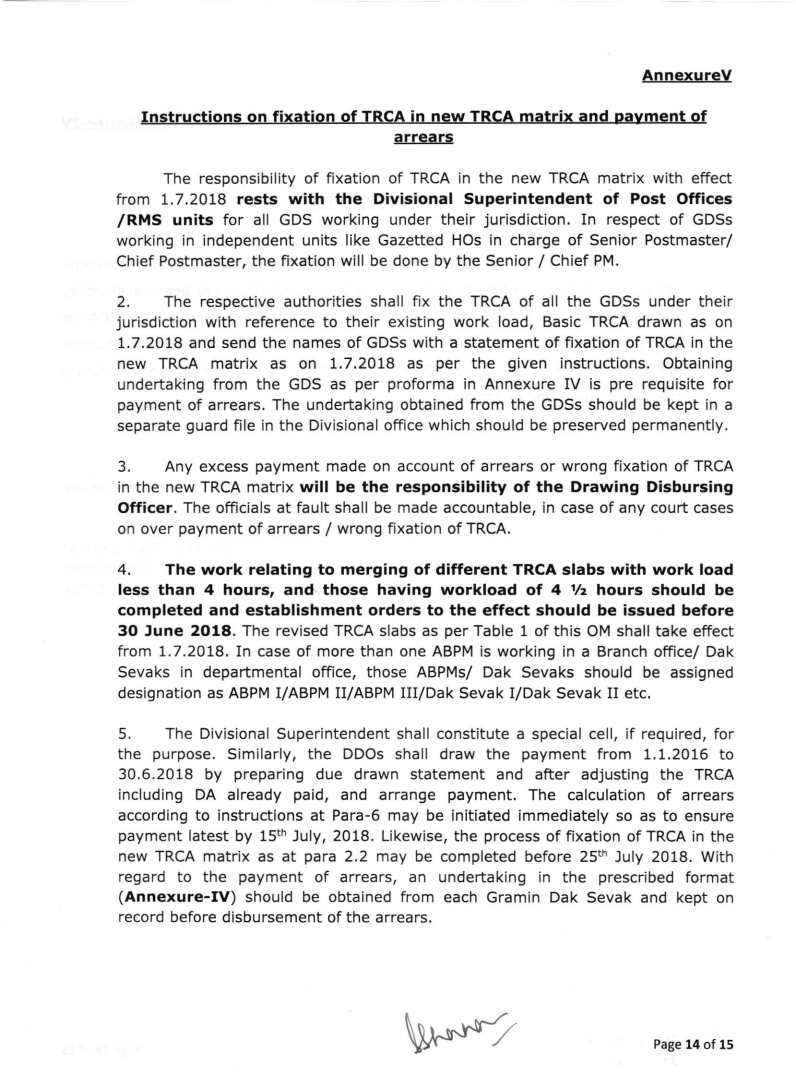

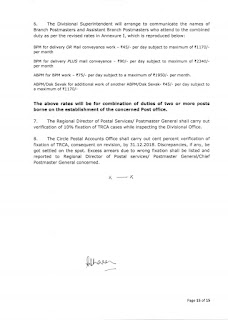

Implementation of recommendations of One-man committee on wages and allowances of Gramin Dak Sevaks (GDSs)

Implementation of recommendations of One-man committee on wages and allowances of Gramin Dak Sevaks (GDSs)

Subscribe to:

Comments (Atom)