GDS Pay Commission

Only for GDS by GDS - India Post

Monday, 11 November 2019

MTS Telangana Circle Notification 2019 & Syllabus.

MTS Telangana Circle Notification 2019 & Syllabus.

Posted by National Union of Postal Employees Group'C , Andhra Pradesh Circle at 07:30No comments:

Email ThisBlogThis!Share to TwitterShare to FacebookShare to Pinterest

MTS Andhra Pradesh Circle Notification 2019

Date : 8.11.2019

MTS Andhra Pradesh Circle Notification 2019

Posted by National Union of Postal Employees Group'C , Andhra Pradesh Circle at 07:30No comments:

Email ThisBlogThis!Share to TwitterShare to FacebookShare to Pinterest

MTS Andhra Pradesh Circle Notification 2019

Date : 8.11.2019

MTS Andhra Pradesh Circle Notification 2019

Friday, 25 October 2019

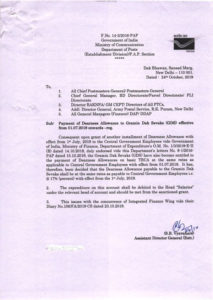

REVISED DA FROM JULY 2019 @ 17% FOR GRAMIN DAK SEWAK

Revised DA from July 2019 @ 17% for Gramin Dak Sewak

F.No. 14-3/2016-PAP

Government of India

Ministry of Communication

Department of Posts

(Establishment Division)/P.A.P. Section

*****

Dak Bhawan, Sansad Marg,

New Delhi — 110 001.

Dated 24th October, 2019

To,

All Chief Postmasters General/ Postmasters General

Chief General Manager, BD Directorate/Parcel Directorate/ PLI Directorate

Director RAKNPA/ GM CEPT/ Directors of All PTCs,

Addl. Director General, Army Postal Service, R.K. Puram, New Delhi

All General Managers (Finance)/ DAP/ DDAP

Sub: Payment of Dearness Allowance to Gramin Dak Sevaks (GDS) effective from 01.07.2019 onwards —reg.

Consequent upon grant of another installment of Dearness Allowance with effect from 1st July, 2019 to the Central Government Employees vide Government of India, Ministry of Finance, Department of Expenditure’s O.M. No. 1/3/2019-E-II (B) dated 14.10.2019, duly endorsed vide this Department’s letters No. 8-1/2016-PAP dated 15.10.2019, the Gramin Dak Sevaks (GDS) have also become entitled to the payment of Dearness Allowances on basic TRCA at the same rates as applicable to Central Government Employees with effect from 01.07.2019. It has, therefore, been decided that the Dearness Allowance payable to the Gramin Dak Sevaks shall be at the same rates as payable to Central Government Employees i.e. @ 17% (percent) with effect from the 1st July, 2019.

Revised DA from July, 2019 @ 17% – Order issued by Finance Ministry

2. The expenditure on this account shall be debited to the Head “Salaries” under the relevant head of account and should be met from the sanctioned grant.

3. This issues with the concurrence of Integrated Finance Wing vide their Diary No.106/FA/2019-CS dated 23.10.2019.

(S.B. Vyavanar )

Assistant Director General (Estt.)

Source: Click here to view/download the PDF

F.No. 14-3/2016-PAP

Government of India

Ministry of Communication

Department of Posts

(Establishment Division)/P.A.P. Section

*****

Dak Bhawan, Sansad Marg,

New Delhi — 110 001.

Dated 24th October, 2019

To,

All Chief Postmasters General/ Postmasters General

Chief General Manager, BD Directorate/Parcel Directorate/ PLI Directorate

Director RAKNPA/ GM CEPT/ Directors of All PTCs,

Addl. Director General, Army Postal Service, R.K. Puram, New Delhi

All General Managers (Finance)/ DAP/ DDAP

Sub: Payment of Dearness Allowance to Gramin Dak Sevaks (GDS) effective from 01.07.2019 onwards —reg.

Consequent upon grant of another installment of Dearness Allowance with effect from 1st July, 2019 to the Central Government Employees vide Government of India, Ministry of Finance, Department of Expenditure’s O.M. No. 1/3/2019-E-II (B) dated 14.10.2019, duly endorsed vide this Department’s letters No. 8-1/2016-PAP dated 15.10.2019, the Gramin Dak Sevaks (GDS) have also become entitled to the payment of Dearness Allowances on basic TRCA at the same rates as applicable to Central Government Employees with effect from 01.07.2019. It has, therefore, been decided that the Dearness Allowance payable to the Gramin Dak Sevaks shall be at the same rates as payable to Central Government Employees i.e. @ 17% (percent) with effect from the 1st July, 2019.

Revised DA from July, 2019 @ 17% – Order issued by Finance Ministry

2. The expenditure on this account shall be debited to the Head “Salaries” under the relevant head of account and should be met from the sanctioned grant.

3. This issues with the concurrence of Integrated Finance Wing vide their Diary No.106/FA/2019-CS dated 23.10.2019.

(S.B. Vyavanar )

Assistant Director General (Estt.)

Source: Click here to view/download the PDF

Wednesday, 7 August 2019

Revision of Syllabus and Pattern of Examinations conducted by Department of Posts for appointment to the posts of Multi Tasking Staff(MTS), Postman, Mail Guard, Postal Assistant and Sorting Assistant

Revision of Syllabus and Pattern of Examinations conducted by Department of Posts for appointment to the posts of Multi Tasking Staff(MTS), Postman, Mail Guard, Postal Assistant and Sorting Assistant

1) To view Dte's letter dated 10.06.2019 , please Click here

2) To view Dte's letter dated 20.06.2019 , please Click here

3) To view Dte's letter dated 26.06.2019 , please Click here

4) To view Dte's letter dated 28.06.2019 , please Click here

5) To view Dte's letter dated 11.07.2019 , please Click here

6) To view Dte's letter dated 23.07.2019 , please Click here

Tuesday, 6 August 2019

Online GDS Notification for Assam, Bihar, Gujarat, Karnataka, Kerala, Punjab Circles - Apply online Last Date 04.09.2019

Assam, Bihar, Gujarat, Karnataka, Kerala, Punjab Circles

Registration, Fee & Apply online start date: 05.08.2019

Registration, Fee & Apply online end date: 04.09.2019

Live Notifications

Stage 2. Fee Payment UR/OBC/EWS Male need to make fee payment. Offline payments can be made at any Head Post Office. List of Post Offices

Stage 3. Apply Online Step 1 . Fill Application. Step 2 . Upload documents. Step 3 . Submit Post preferences. Preview and take print out.Completion of these three steps will only be treated as submission of application.

Subscribe to:

Comments (Atom)