Only for GDS by GDS - India Post

Showing posts with label Allowances. Show all posts

Showing posts with label Allowances. Show all posts

Wednesday, 13 March 2019

Saturday, 11 August 2018

Thursday, 26 July 2018

RTI Act : Departmental Committee Recommendations of Pay and Allowances of GDS, Min. of Finance objections & Cabinet Note by DoP and approved recommendations by Central Cabinet

Right to Information Act : Departmental Committee Recommendations , Finance Ministry & PMO Objections , Cabinet Note by DoP and approved recommendations by Central Cabinet

Tuesday, 26 June 2018

GDS Pay Revision for Existing and Revised Allowance

GDS implementation for Existing and Revised Allowance

| Item | Existing Allowances | Revised Allowances |

| Allowances | ||

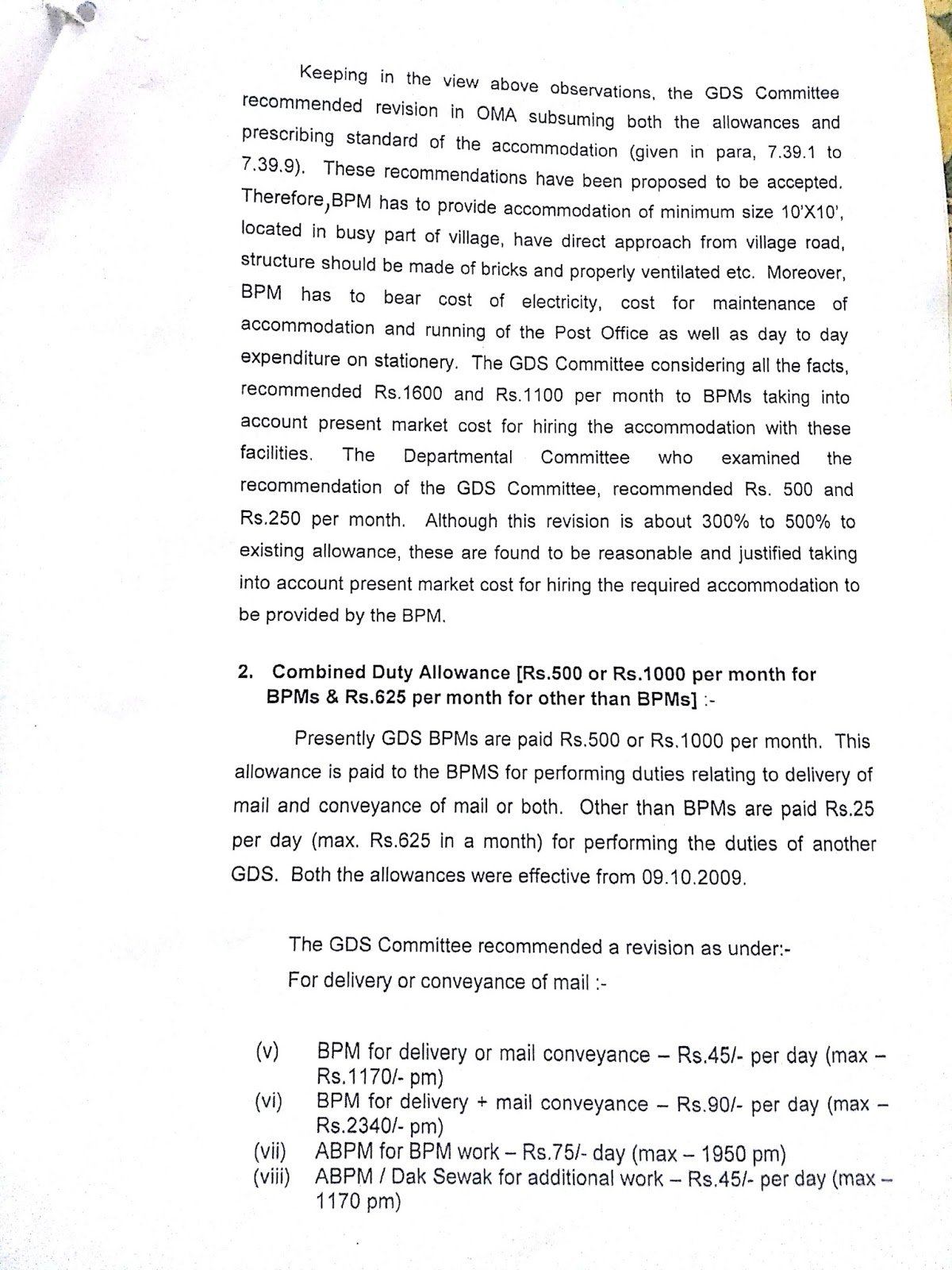

| Office Maintenance allowance (OMA) (For BPMs Only) | ₹ 100/- pm | Composite Allowance (in lieu of OMA) is revised as follows (For BPMs only) BPMs providing GDS Post Office accommodation which meets the prescribed standards – ₹ 500/- per month BPMs having BOs at non-standard/rent free accommodation- ₹ 250/- per month |

| Fixed Stationary Charge | ₹25/- pm for BPMs ₹10/- pm for other than BPMs |

₹25/- ABPMS and Dak Sevaks. FSC subsumed in composite allowance for BPMs. |

| Boat Allowance | ₹ 50/- pm | ₹115/- per month |

| Cash conveyance Allowance | ₹50/- pm | There will be no fixed cash conveyance allowance. Instead, payment will be at following rates: (a) Payment of ₹30/- per occasion plus actual conveyance charges for cash conveyance of an amount less than ₹ 1 Lakh subject to maximum of charges incurred for transport by public bus and; (b) ₹ 50/- per occasion plus actual conveyance charges for an amount more than ₹ 1 Lakh subject to maximum of charges incurred for transport by public bus. |

| Cycle Maintenance Allowance | ₹90/- pm | ₹180/- pm |

| Combined Duty Allowance | 1. GDS Branch Postmasters performing delivery or conveyance duties or both will be paid ₹500 p.m for each item of work separately. 2. If the Branch postmaster is performing delivery at the BO village only, it will be restricted to ₹250 p.m 3. BPM exchanging Mails at Bus stand or at Railway Stations will be compensated at the rate of ₹250 p.m |

BPM for delivery OR Mail Conveyance work – ₹45/- per day subject to maximum of ₹1170/- per month BPM for delivey PLUS mail conveyance – ₹90/- per day subject to maximum of ₹2340/- per month ABPM for BPM work – ₹75/- per day subject to a maximum of ₹1950/- per month. ABPM/DAk Sevak for additional work of another ABPM/Dak Sevak – ₹45/- per day subject to a maximum of ₹1170/- These rates will be for combination of duties of two or more posts borne on the establishment of the office. |

| Risk and Hardship Allowance | Nil | Risk and Hardship allowance @ of ₹500/- per month to the GDS working in areas which are identified for this allowance. (as identified by Government of India, as per 7th CPC Recommendations) |

Tuesday, 15 May 2018

Sunday, 29 April 2018

Recommended Allowance By GDS Pay Committee 2016

As per Nataraja Murti Committee 2007 (GDS Pay Committee 2007), Garmin Dak Sevak are now getting some allowance like Dearness Allowance 142% on basic, Office Maintenance Allowance (OMA) 100/-, Stationary Allowance (SA) 50, Combined Duty Allowance 500/- CCA 25/-, Cycle Maintenance Allowance 10/- etc. but GDS Pay Committee 2016 (Kamalesh Chandra Committee) has recommended more allowance then previous pay committee constitute by Government for reviewing the pay of Gramin Dak Sevak. Here is the Recommended Allowance by GDS Pay Committee 2016.

Dearness Allowance :-

GDS should be paid same percentage of DA as paid to the central government employees from time to time. The present DA of CG employee is 7%.

Composite Allowance :-

Composite Allowance is depend on the GDS category, accommodation and working place which is GDS Post Office and Departmental,Post Office. GDSs Working in GDS Post Offices –

- BPMs providing GDS Post Office Accommodation which meets the prescribed standards will get 1600/-

- BPMs providing Accommodation which does not meets the prescribed standards will get 1100/-

- BPMs having Post Office in rent free government Accommodation and staying in the Post Village will get 1100/-

- Assistant BPMs working in GDS post office and staying in the post village should be paid will get 800/-

GDSs working in Departmental Post offices –

- Dak Sevaks working in “X” Class Cities/Towns will get 2400/-

- Dak Sevaks working in “Y” Class Cities/Towns will get 1600/-

- Dak Sevaks working in “Z” Class Cities/Towns will get 800/-

Cash Conveyance Allowance :-

BPM/ABPM/Dak Savak may be paid minimum Rs. 50/- rupees for conveyance of cash up to Rs. 50,000/-. They may be paid Rs. 10/- for conveyance of every additional Rs. 10,000/-.

Children Education Allowance :-

GDSs should be paid children Education Allowance @Rs. 6000/- per child per annum for maximum of two children. This amount may be paid in two installments.

Combined Duty Allowance :-

Recommended Daily Rates

| |

| BPMs doing combined duty of ABPM in same office. | Rs. 65/- per working day for maximum 89 days at a stretch. |

| ABPMs doing combined duty of BPM in same office. | Rs. 75/- per working day for maximum 89 days at a stretch. |

| Dak Sevaks doing combined duty of another Dak Sevaks in same office. | Rs. 65/- per working day for maximum 89 days at a stretch. |

Revenue Linked Allowance :-

BPMs should be paid Revenue Linked Allowance @ Rs. 10% of the total amount of additional revenue generated beyond prescribed norms in a month. Revenue Linked Allowance will not be applicable for other GDS.

Risk and Hardship Allowance :-

Risk and Hardship Allowance should be paid @ Rs. 500/- per month to the GDSs working in areas which are indentified for payment of Risk and Hardship Allowance as per 7th CPC recommendations.

Click Here to Download PDF format.

Thursday, 1 March 2018

Cabinet approves Amendments to Housing and Telephone Facilities Rules, Constituency and Office Expense Allowance Rules for MPs

Cabinet approves Amendments to Housing and Telephone Facilities Rules, Constituency Allowance Rules and Office Expense Allowance Rules for MPs

The Union Cabinet chaired by Prime Minister Shri Narendra Modi has approved Amendment to

(i) The Housing and Telephone Facilities (Members of Parliament) Rules, 1956

(ii) The Members of Parliament (Constituency Allowance) Rules, 1986,

(iii) The Members of Parliament (Office Expense Allowance) Rules, 1988.

The details are:

Increase in the monetary ceiling of furniture at residence of Members of Parliament from Rs. 75,000/- (Rs. 60,000/- for durable and Rs. 15,000/- for nondurable) to Rs. 1,00,000/- (Rs. 80,000/- for durable and Rs. 20,000/- for nondurable) w.e.f. 01.04.2018 which shall be increased after every five years commencing from 01.04.2023 on the basis of Cost Inflation Index provided under clause (v) of Explanation to section 48 of the Income-tax Act, 1961.

Broadband internet facility may be provided to Members of Parliament w.e.f. August 2006 against 10,000 surrendered call units per annum on land line connection. The facility of broadband internet to Members of Parliament is already in practice since August, 2006 and it will now be incorporated in ‘the Housing and Telephone Facilities (Members of Parliament) Rules, 1956’ for its regularization through its amendment with retrospective effect by inserting a new rule.

Wi-fi zone with monthly tariff plan of Rs. 1700/- from 1.9.2015 to 31.12.2016 and Rs. 2200/- from 1.1.2017 onwards may be created in the Members’ residential areas for providing high speed internet connection (FTTH connection). This facility will be in addition to the existing broadband facility. For this purpose, three new sub-rules are to be inserted in ‘the Housing and Telephone Facilities (Members of Parliament) Rules, 1956’.

Increase in the Constituency Allowance for Members of Parliament from Rs. 45,000/- per month to Rs. 70,000/- per month w.e.f. 1.4.2018 which shall be increased after every five years commencing from 01.04.2023 on the basis of Cost Inflation Index provided under clause (v) of Explanation to section 48 of the Income-tax Act, 1961.

Increase in the Office Expense Allowance for Members of Parliament from Rs. 45,000/- per month (Rs. 15,000/- for expenses on stationary items and postage plus Rs. 30,000/- for a computer literate person engaged by Member of Parliament for obtaining secretarial assistance) to Rs. 60,000/- per month (Rs. 20,000/- for expenses on stationary items and postage plus Rs. 40,000/- for a computer literate person engaged by Member of Parliament for obtaining secretarial assistance) w.e.f. 01.04.2018 which shall be increased after every five years commencing from 01.04.2023 on the basis of Cost Inflation Index provided under clause (v) of Explanation to section 48 of the Income -tax Act, 1961.

The decision of the Cabinet shall be conveyed to the Joint Committee on Salaries and Allowances of Members of Parliament for making amendments in the relevant rules which shall be get approved and confirmed by the Chairman of the Council of States and the Speaker of House of the People and will be published in the Official Gazette.

Additional financial implication on account of the decision taken by the Cabinet would be Rupees 39,22,72,800/- (Rupees Thirty nine crores, twenty two lakhs, seventy two thousand & eight hundred) approximately of recurring expenditure and Rupees 6,64,05,400/- (Rupees Six crores, sixty four lakhs five thousand & four hundred) approximately of non-recurring expenditure.

Background:

Article 106 of the Constitution provides that the Members of either House

of Parliament shall be entitled to receive such salaries and allowances as may from time to time be determined by Parliament by law. Consequently, the Salary, Allowances and Pension of Members of Parliament Act (MSA Act) was enacted in 1954 (Act 30 of 1954). Section 9 of the MSA Act provides for constitution of a Joint Committee of both Houses of Parliament for the purpose of making rules under the Act. The Joint Committee has the powers to make rules after consultation with the Central Government to provide for all or any of the matters enumerated in the said section.

The Union Cabinet chaired by Prime Minister Shri Narendra Modi has approved Amendment to

(i) The Housing and Telephone Facilities (Members of Parliament) Rules, 1956

(ii) The Members of Parliament (Constituency Allowance) Rules, 1986,

(iii) The Members of Parliament (Office Expense Allowance) Rules, 1988.

The details are:

Increase in the monetary ceiling of furniture at residence of Members of Parliament from Rs. 75,000/- (Rs. 60,000/- for durable and Rs. 15,000/- for nondurable) to Rs. 1,00,000/- (Rs. 80,000/- for durable and Rs. 20,000/- for nondurable) w.e.f. 01.04.2018 which shall be increased after every five years commencing from 01.04.2023 on the basis of Cost Inflation Index provided under clause (v) of Explanation to section 48 of the Income-tax Act, 1961.

Broadband internet facility may be provided to Members of Parliament w.e.f. August 2006 against 10,000 surrendered call units per annum on land line connection. The facility of broadband internet to Members of Parliament is already in practice since August, 2006 and it will now be incorporated in ‘the Housing and Telephone Facilities (Members of Parliament) Rules, 1956’ for its regularization through its amendment with retrospective effect by inserting a new rule.

Wi-fi zone with monthly tariff plan of Rs. 1700/- from 1.9.2015 to 31.12.2016 and Rs. 2200/- from 1.1.2017 onwards may be created in the Members’ residential areas for providing high speed internet connection (FTTH connection). This facility will be in addition to the existing broadband facility. For this purpose, three new sub-rules are to be inserted in ‘the Housing and Telephone Facilities (Members of Parliament) Rules, 1956’.

Increase in the Constituency Allowance for Members of Parliament from Rs. 45,000/- per month to Rs. 70,000/- per month w.e.f. 1.4.2018 which shall be increased after every five years commencing from 01.04.2023 on the basis of Cost Inflation Index provided under clause (v) of Explanation to section 48 of the Income-tax Act, 1961.

Increase in the Office Expense Allowance for Members of Parliament from Rs. 45,000/- per month (Rs. 15,000/- for expenses on stationary items and postage plus Rs. 30,000/- for a computer literate person engaged by Member of Parliament for obtaining secretarial assistance) to Rs. 60,000/- per month (Rs. 20,000/- for expenses on stationary items and postage plus Rs. 40,000/- for a computer literate person engaged by Member of Parliament for obtaining secretarial assistance) w.e.f. 01.04.2018 which shall be increased after every five years commencing from 01.04.2023 on the basis of Cost Inflation Index provided under clause (v) of Explanation to section 48 of the Income -tax Act, 1961.

The decision of the Cabinet shall be conveyed to the Joint Committee on Salaries and Allowances of Members of Parliament for making amendments in the relevant rules which shall be get approved and confirmed by the Chairman of the Council of States and the Speaker of House of the People and will be published in the Official Gazette.

Additional financial implication on account of the decision taken by the Cabinet would be Rupees 39,22,72,800/- (Rupees Thirty nine crores, twenty two lakhs, seventy two thousand & eight hundred) approximately of recurring expenditure and Rupees 6,64,05,400/- (Rupees Six crores, sixty four lakhs five thousand & four hundred) approximately of non-recurring expenditure.

Background:

Article 106 of the Constitution provides that the Members of either House

of Parliament shall be entitled to receive such salaries and allowances as may from time to time be determined by Parliament by law. Consequently, the Salary, Allowances and Pension of Members of Parliament Act (MSA Act) was enacted in 1954 (Act 30 of 1954). Section 9 of the MSA Act provides for constitution of a Joint Committee of both Houses of Parliament for the purpose of making rules under the Act. The Joint Committee has the powers to make rules after consultation with the Central Government to provide for all or any of the matters enumerated in the said section.

Wednesday, 28 June 2017

Cabinet approves recommendations of the 7th CPC on allowances

i. The recommendations of 7th CPC to abolish Cycle Allowance, granted mainly to Postmen and trackmen in Railways, has not been accepted. Keeping in view the specific requirement of this allowance for postmen in Department of Posts and trackmen in Railways, the cycle allowance is retained and the rates have been doubled from 90 per month to 180 per month. This will benefit more than 22,200 employees.

PIB

PIB

Wednesday, 19 April 2017

A GDS official at one level will be at that level only for ever and getting 10% allowance for the revenue generation over 100% is not at all possible : GDS Committee Recommondations regarding Revenue Generation

GDS Pay Committee Recommendations - formula for calculation of expenditure & Revenue norms & monthly Revenue of of GDS Post offices : A GDS official at one level will be at that level only for ever and getting 10% allowance for the revenue generation over 100% is not at all possible.

There is no chance to grow up from level 1 to level 2 and to getting 10% allowances above 100% revenue generation will not be so easy for level 2.

We illustrate practical statistics as below

The GDS Pay Committee has given the table (table 4.18 ) for calculation of monthly revenue of GDS Post offices. On observation on income side getting more income is very difficult as to rough calculations a B.O. transacted

3,000 RD : 3,000 ×63.74÷12 = 15,935 /-

1,500 SB : 1500 × 63.74 ÷12 = 7 ,967 /-

1,500 MGNREGS :1500 × 24.88 12 = 3, 110 /-

Monthly RPLI collection : 1,00,000 ×4÷ 100

Approx.(150 P0licies ) = 4 ,000 /-

Will get around Rs.31,012 /- income per month.

Where as , as per below Expenditure table (No.4.19 expenditure table) the average expenditure on a B.O. will be around Rs.36,000 as given in the table in respect of double handed offices. Totally doing the above 6,000 above transactions is remote in a village.

There is no chance to grow up from level 1 to level 2 and to 10% above 100% revenue will not be so easy for level 2. It appears that an official at one level will be at that level only for ever and getting 10% allowance for the revenue over 100% is not at all possible.

CH.Laxmi Narayana

President , NUGDS

GDS Pay Committee Recommendations - formula for calculation of expenditure & Revenue norms & monthly Revenue of of GDS Post offices.

Revision of method for calculation of Income and Cost of Branch Post Offices - Reg.

Subscribe to:

Posts (Atom)